When a loved one passes away, their estate often goes through a legal process known as probate. This process involves the validation of the deceased’s will (if one exists) and the distribution of their assets under court supervision. One of the most common questions we encounter at Shaikh Law Firm is: “How much does an estate have to be worth to go to probate?”

This page aims to provide a comprehensive overview of the probate process in Ontario, focusing on the financial thresholds that may exempt an estate from probate or subject it to this legal procedure.

A Probate is a court process that confirms the validity of a will and the executor’s authority to distribute the deceased’s assets. In cases where there is no will, probate serves to appoint an individual to manage and distribute the estate according to provincial laws.

Next Steps and Legal Procedures

The passing of a loved one is a challenging time, and navigating legal obligations can be overwhelming. Here are some essential steps and considerations:

Ensures the will is legally valid and reflects the deceased's final wishes. If no will, appointes an executor.

Grants legal authority to the executor to act on behalf of the estate, providing protection from personal liability.

The requirement for probate and the associated fees can vary significantly depending on the value of the estate. In Ontario, the key considerations regarding the estate’s value and the necessity for probate are as follows:

Small Estates

Ontario recognizes a “small estate” as one with a total value of $50,000 or less. Small estates may be subject to a simplified probate process, designed to reduce the complexity and cost of administering smaller estates.

Estates Exceeding the Small Estate Threshold

For estates valued above $50,000, the standard probate process applies. The probate fees (officially known as the Estate Administration Tax) are calculated based on the total value of the estate’s assets. As of the latest update, the fees are structured as follows:

No estate administration tax is payable on the first $50,000 of the estate value.

For the value of the estate over $50,000, the tax is calculated at a rate of 1.5%.

It’s important to note that not all assets are subject to probate. Certain types of assets may bypass the probate process entirely, such as:

At Shaikh Law Firm, we provide a comprehensive range of services to address all aspects of wills, estates, and probate law, ensuring your needs are met with expertise and care:

Connect with us to discuss how our specialized services can assist you in planning and securing your legacy with precision and foresight.

The key benefit of having a will in Canada is the control it gives you over who receives your property and how it is divided among your beneficiaries. Creating a will is a crucial step in managing your estate and ensuring your wishes are respected.

Therefore, if you own property, have any form of assets such as a balance in the bank, a car, or if you have minor children and want to ensure your assets are divided as per your wish, and/or your minor child has a guardian after your death, it is important to have a will in Canada.

At Shaikh Law Firm, we understand the intricacies of creating a will that accurately reflects your desires and needs. Contact us today to ensure your legacy is secured and your loved ones are protected.

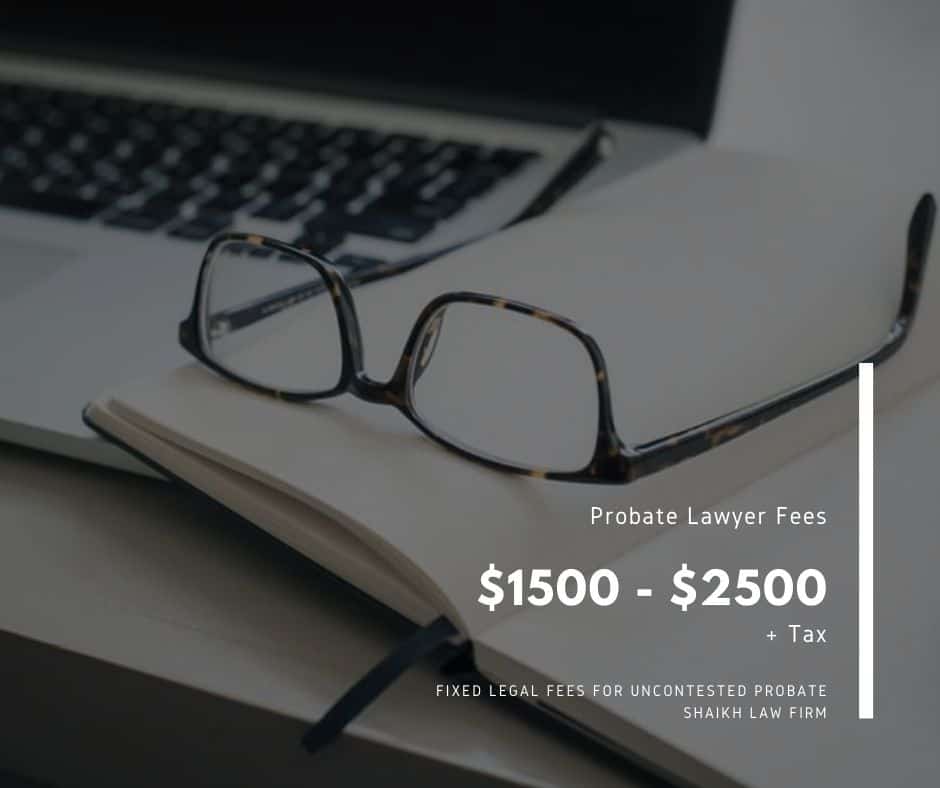

No. A short answer is you do not need a lawyer to file for a probate application. There is no legal requirement to hire a lawyer to file a probate application in Ontario.

However, it is essential to understand that a probate lawyer would be qualified to draft the probate application as per Ontario’s civil procedure rules. An experienced estate lawyer or a probate lawyer can look after all aspects of a probate application. The chances of rejection of a probate application would be less if you were to retain an estate & probate lawyer who is more experienced in drafting such applications. Your lawyer will be responsible for attending to any court objections and resolving such complaints to the judge’s satisfaction.

A probate lawyer can also advise a tax-efficient way to file probate and guide you to take steps to protect assets and what other measures are needed other than probate application.

Overall, an estate lawyer can get the probate process completed faster than others. A probate lawyer will be your go-to person if you run into a problem when distributing the assets.

Our passion, experience, and unwavering commitment to our client’s success sets us apart from others.

(905) 795 7757

info@slclawyer.ca

(905) 795 1271

15 Minutes

Multiple Meeting Locations