Planning for the future is one of life’s most important steps. At Shaikh Law Firm, our experienced Wills and Estates Lawyers help individuals and families across Ontario prepare with confidence through our multiple office locations.

Whether you need a professionally drafted will, probate assistance, or a complete estate plan, we provide clear, affordable legal solutions tailored to your needs.

With over three decades of combined experience, we understand that every family’s situation is unique. That’s why we offer flat-fee pricing, no hidden charges, and a free 15-minute consultation, so you can secure your legacy without financial uncertainty.

From appointing guardians for minor children to protecting family assets through strategic estate planning, our dedicated team guides you through every step of the process with expertise and compassion.

Expert legal guidance across all aspects of estate planning, probate, and succession matters in Ontario.

Comprehensive will drafting, estate planning, and family protection strategies

Expert guidance through probate applications, estate administration, and asset distribution

Business succession, family trusts, tax efficiency, and complex estate structures

Free Consultation

Not sure which service you need? Book your free 15-minute consultation to discuss your specific situation.

A will matters because it allows you to decide how your assets are distributed, provides for loved ones, appoints an executor to manage your estate, names guardians for minor children, and reduces the potential for family conflict, court intervention, and delays after your death.

Without a will, an Ontario court will decide how to distribute your estate according to provincial laws, which may not reflect your wishes and can lead to costly and stressful complications for your family.

Control over your estate – Decide who inherits your property, investments, and digital assets.

Provide for your loved ones – Ensure that your family, friends, and chosen charities are looked after.

Choose a trusted executor – Appoint a responsible person to manage debts, taxes, and asset distribution.

Protect your children – Name guardians for minors rather than leaving the decision to the courts.

Prevent family conflict – Reduce the likelihood of disputes and costly legal challenges.

Save time and costs – Simplify estate administration and minimize delays.

Avoid intestacy laws – Prevent your estate from being distributed under provincial default rules.

Secure your legacy – Ensure your assets benefit the people and causes that matter most to you.

The key benefit of having a will in Canada is the control it gives you over who receives your property and how it is divided among your beneficiaries. Creating a will is a crucial step in managing your estate and ensuring your wishes are respected.

Therefore, if you own property, have any form of assets such as a balance in the bank, a car, or if you have minor children and want to ensure your assets are divided as per your wish, and/or your minor child has a guardian after your death, it is important to have a will in Canada.

At Shaikh Law Firm, we understand the intricacies of creating a will that accurately reflects your desires and needs. Contact us today to ensure your legacy is secured and your loved ones are protected.

No, you do not need a lawyer to prepare a will in Ontario. While Canadian law does not mandate the use of a lawyer for preparing a will, and even a handwritten will can be legally valid, the role of a lawyer in this process is invaluable, especially in more complex situations.

Next Steps and Legal Procedures

The passing of a loved one is a challenging time, and navigating the legal obligations can be overwhelming. Here are some essential steps and considerations:

No. A short answer is you do not need a lawyer to file for a probate application. There is no legal requirement to hire a lawyer to file a probate application in Ontario.

However, it is essential to understand that a probate lawyer would be qualified to draft the probate application as per Ontario’s civil procedure rules. An experienced estate lawyer or a probate lawyer can look after all aspects of a probate application. The chances of rejection of a probate application would be less if you were to retain an estate & probate lawyer who is more experienced in drafting such applications. Your lawyer will be responsible for attending to any court objections and resolving such complaints to the judge’s satisfaction.

A probate lawyer can also advise a tax-efficient way to file probate and guide you to take steps to protect assets and what other measures are needed other than probate application.

Overall, an estate lawyer can get the probate process completed faster than others. A probate lawyer will be your go-to person if you run into a problem when distributing the assets.

An amendment to a Will is referred to as a Codicil to a Will. A Codicil is prepared to make minor changes, such as adding or removing a beneficiary of the Will.

The cost of a Will in Onttario varies drastically between online Will template to Wills professionally drawn up by a Wills lawyer in Ontario. Average, an online Will template costs between $39 to $90. In contrast, a Lawyer specializing in Wills costs from $180 to $450 to prepare a Will.

At Shaikh Law Firm we keep it simple. We have fixed cost of a Will in Ontario, including Law Office Disbursements.

Last Will

A Last Will is a Legal document recording direction on how to distribute all assets & properties among beneficiaries after death.

Living Will

A Living Will, also known as a healthcare directive, is a legal document recording personal health care directives applicable when you are incapable of making a decision, such as physical or mental incapacity.

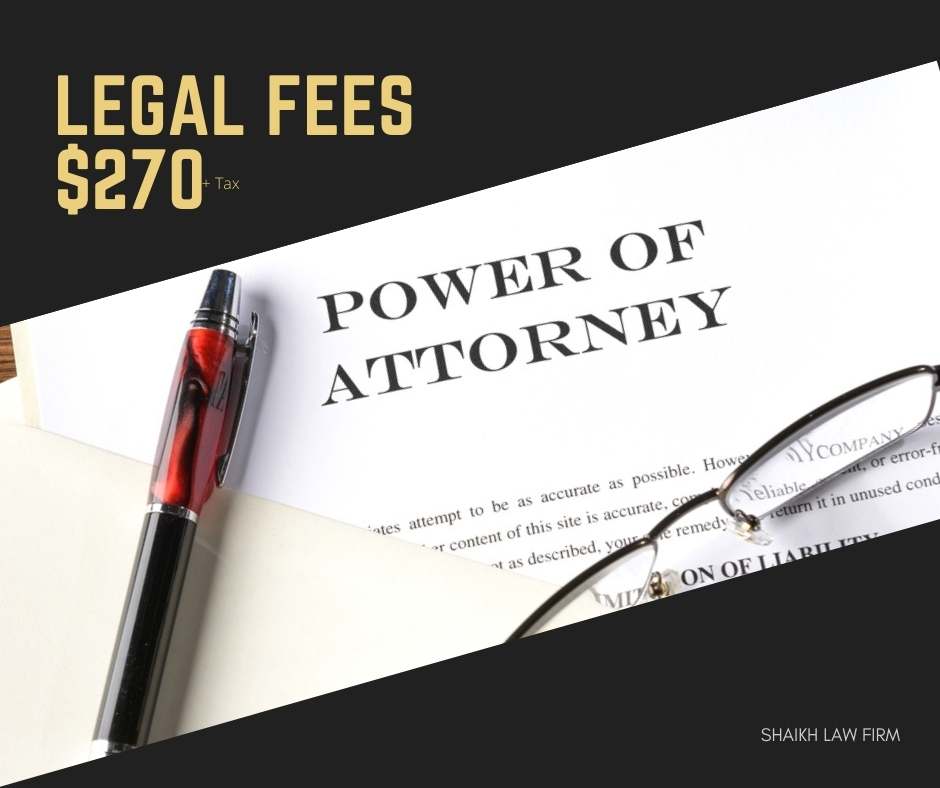

Our Wills Lawye can professionally draft a Power of Attorney for $270 + Tax.

INCLUDED IN LEGAL FEES;

Our Wills and Estates Lawyer Fees for drafting a single Will is $450 + Tax and $720 for mirror wills (between spouses).

WILLS LAWYER FEES INCLUDED;

(905) 795 7757

info@slclawyer.ca

(905) 795 1271

Helping You Navigate Wills, Estates, and Probate Law

We have Multiple Meeting Location Across Greater Toronto Area.

Toronto Downtown |Mississauga| Brampton | Oakville | Hamilton | Scarborough |Kitchener |