Trying to get the best mortgage rate is an important task when buying a house but it is equally important to know your real estate lawyer’s fees and disbursements.

At Shaikh Law Office we offer transparent real estate lawyers legal fees and disbursements in Ontario. You can find out an estimate of how much it is going to cost you to purchase, sell or refinance a property within seconds when you use our online tools.

Closing costs calculator when buying a propertyProperty Purchase Price

Type of Property

Where is the Property Located

First Time Home Buyer

Are You Obtaining Mortgage/Financing

Full Name

Phone Number

Email

Real Estate Lawyer Fees

Legal Fees *

0

Legal Fees for Mortgage (With A Lender)

0

Disbursements (Included in Legal Fees)

0

Closing Costs

Government Registration Fees

0

Ontario Land Transfer Tax

0

Toronto Land Transfer Tax (Including Admin Fees $109.25)**

0

Less First time Home Buyer Rebate

0

Total Land Transfer Tax

0

Unity Charges

$270.00

Disbursements

$450.00

Title Insurance

0

HST on Applicable Items

0

Total Cost

0

|

Closing costs calculator when selling a propertyProperty Sale Price

Type of Property

Are You Paying Off a Mortgage/ Loan

How Many Payouts

Full Name

Phone Number

Email

Real Estate Lawyer Fees

Legal Fees *

0

Disbursements (Included in Legal Fees)

0

Closing Costs

Additional Payouts ($63 +HST each)

0

Law Society Transaction Levy

0

Unity Charges

0

Disbursements

$450.00

HST on Applicable Items

0

Total Cost

0

|

Closing costs calculator for refinanceRefinance/ Mortgage/ Loan Amount

Type of Property

Are you Paying off a Mortgage

How Many Payouts

Full Name

Phone Number

Email

Real Estate Lawyer Fees

Legal Fees *

0

Disbursements (Included in Legal Fees)

0

Closing Costs

Government Registration Fee(s)

$78.79

Additional Payouts ($63 +HST each)

0

Title Insurance (Estimate Cost)

0

HST on Applicable Items

0

Total Cost

0

|

A guideline on Average Closing Costs in Ontario ranges between 1.5% to 4% of the Purchase Price, for instance, the closing cost for a property purchase price at $500,000/- would vary between $7,500/- to $20,000/-.

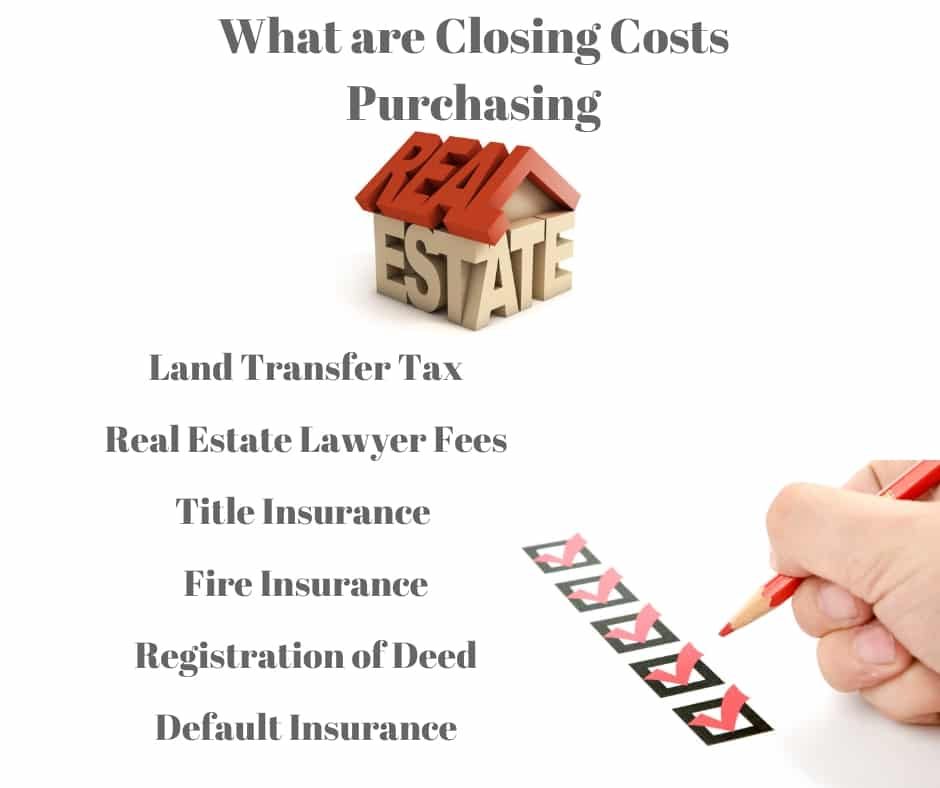

Closing costs generally referred to as Land Transfer Tax, Real Estate Lawyer Fees, Expenses, and Costs that would need to be paid at the time of home purchase and on top of down payment.

Closing costs when buying a house or a Condo varies from City to City and Province to Canada.

It is crucially important to budget for closing costs when buying a property because it is an additional expense on top of moving expenses.

Minimum Closing Costs when buying a home includes:

Closing Cost when buying a House in Ontario valued at $500,000/– located out of the City of Toronto & the purchaser is not a first time home buyer.

Total Closing Cost $8,711.15

A down payment is a buyer contribution towards the total purchase price. A mortgage usually covers the remaining balance of the purchase prices.

You need 5% down payment in Canada if your home purchase price is $500,00 or less. If the purchase price is between $500,000 to $999,999 then 5% for value upto $500,000 and 10% for value between $500,000 to $999,999.

Similarly, if the purchase price is $1,000,000 (Million) and above, then a minimum 20% downpayment is required.

NOTE: Poor Credit Score or Self-Employment could affect the basic criteria for a downpayment.

| Purchase price of your home | Minimum amount of down payment |

|---|---|

| $500,000 or less | 5% of the purchase price |

| $500,000 to $999,999 | 5% of the first $500,000 of the purchase price 10% for the portion of the purchase price above $500,000 |

| $1 million or more | 20% of the purchase price |

Home Inspection Fees: $500 to $800 Optional costs but strongly recommended to have it done. Usually, it is as a condition to the Offer to purchase.

Appraisal Fees: $300 to $500 some lenders would prefer to appraise the home before granting the loan. (optional).

Condo Certificate/ Estoppel Certificate: $100 to $200. If you are buying a Condo, your lawyer needs to review the condo or strata certificate to confirm that the condo is free from any claims, liens or charges.

CMHC Fees or Default Insurance Cost: If you down payment is less then 20%, you will pay for default insurance.

| Loan up to 85% | 1.80% Fees |

| Loan up to 90% | 2.40% Fees |

| Loan up to 95% | 3.60% Fees |

| Loan 90.01 to 95% Non-Traditional | 3.85% Fees Non – Traditional: 5% down for less than $500,000 and 10% down for more than $500,000. Credit Score: 650 Recommended Debit to service ratio: between 42 to 44% Only one mortgage. |

Closing costs when selling a house in Ontario are mostly limited to three items

1.Realtor commission,

2.Real Estate Lawyers Fees,

3. Mortgage payout charges.

The highest cost for the sale of a property is the realtor’s commission. One must keep in mind that 3% is usually charged if your realtor brings a client; if another realtor is involved for the purchaser, the commission may go up to 5% of the property value.

The Lawyer is Fees and disbursements are not as high as realtor’s commission but do add up to the total amount.

At Shaikh Law, a Real Estate Lawyer would charge his fees for sale of a property is $900+ Tax, plus disbursements, please use our closing costs calculator above.

If your mortgage is not ready for renewal, you may end up paying for breaking the term of the mortgage. Depending on the Financial institutions and terms of your mortgage, you may end up paying a minimum of 3 months of interest or a maximum of a few thousand.

It would be best if you reach out to your financial institution to inquire what charges would apply if you were to break your mortgage prior to completion of the term of your mortgage.

Real Estate Agent’s Commission between 3% to 5% + Tax.

Real Estate Lawyers Fees $900 + Tax.

Mortgage Prepayment Charges (Estimate) 3 months interest in some cases.

The Closing Cost to Refinance a property includes the cost of

1. Mortgage broker’s Commission if going through B-lender

2. Real Estate Lawyer’s Fees

3. Payouts such as an existing mortgage, Credit Cards, Line of Credit.

4. Title Insurance.

5. Law Society Levy.

6. Registration of Refinance Charge

(905) 795 7757

info@slclawyer.ca

(905) 795 7757

We serve clients across the province of Ontario, Canada, if your city is not below listed please contact our Head Office.

Toronto Downtown |Etobicoke |Mississauga | Streetsville |Brampton | Oakville | Hamilton | Guelph | Kitchener | Cambridge | Scarborough | North York | Markham | Vaughan | Richmond Hill | Barrie | Ottawa | London | Oshawa |